Most crypto traders and investors fear the bear. But the truth is that no market, certainly not crypto, goes up in a straight line. What goes up must come down.

While 2020 was quite a great moment for the crypto industry, 2021 and until now have witnessed more of the bear with bitcoin lounging around the $30k price and most crypto and altcoins staying in the low.

That said, you don’t have to be negative about the current market state, even if your portfolio is in the red. The bear market can still help you make a lot of money. Here’s how.

- Calm Down

Our first tip is also the most important. As you see your coins’ values take a deep dive, it’s tempting to cut your loss. After all, it’s a healthy practice to cut down on your loss.

However, selling after a huge drop contradicts the golden rule of any investment or trading- buy low, sell high. Sure, it’s difficult to time the market. But selling at a loss only locks in your losses. Also, if you do cut your loss, then you won’t benefit when crypto starts to move up again.

So, if the bear market caught you off guard, take a deep breath and control your emotional impulse to tap the sell button. Remind yourself of why you’ve invested in crypto. Do your research and determine if your original investment plan can still support the current situation. If so, don’t sell.

- Try Other Crypto Trading Strategies

In terms of crypto trading, there are various trading strategies you can try other than traditional buying and selling. These include:

- Scalp Trading

Scalp trading refers to the short-term buying and selling of crypto assets. With this method, you take advantage of the volatility of the crypto market by monitoring and making trades depending on the small, hourly, or daily movement of altcoins. This trading strategy is often beneficial for sideways markets, but it can help you earn some money even in a bear market.

Scalp trading is often recommended to more experienced crypto traders. However, technology has now allowed even the less experienced traders to do scalp trading. With crypto grid trading bots, you can automate your scalp trading strategies that allow you to make money even during a bear market.

While you may gain small earnings from each buy and sell transaction, these conversions can add up over time and generate a good amount of funds in the long run.

- Staking

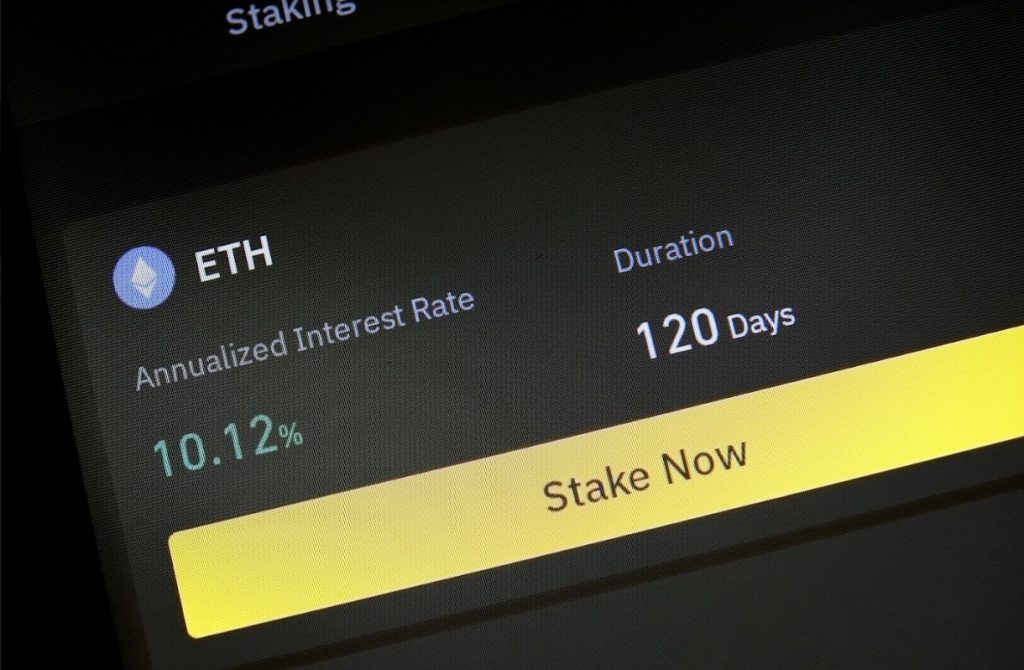

Staking refers to locking in your altcoins for a specific period to obtain interest and rewards. It’s somewhat similar to loaning your altcoins, but instead of investing it, borrowers used it to validate transactions in a blockchain network of your choice.

In general, the more you stake, the higher priority you gain to validate transactions, and this results in more earnings. That said, how much you earn depends on the network. However, staking interest rates can be quite generous. In some cases, you earn up to 10-20% annually, making it a profitable way to invest your crypto.

- Short Selling

Most traders utilize short selling during a bear market to take advantage of the downtrend.

Unlike regular trading or going long, where ‘buy low, sell high,’ short selling means you ‘sell first, buy later.’

It refers to selling a crypto asset that you don’t even own. In general, you borrow a crypto asset and sell it. Then, you purchase it later at a lower price while earning the difference after repaying your initial loan.

- Use Dollar-Cost Averaging

A bearish market is a great opportunity to accumulate altcoins at a bargain price. This is why ‘buy the dip’ is a common slang thrown by investors and traders whenever the crypto market goes down.

But you shouldn’t buy the dip without a strategy. Most people buy in a lump sum or invest all their money at once. This can be problematic if the market continues to crash after entering. A better way to do this is to use dollar-cost averaging (DCA).

This strategy means you buy small quantities of a crypto asset over a certain period. Let’s say you want to invest an additional $1,000 in Cardano, instead of investing all of it in one go, you divide the amount into several purchases as the price continues to drop.

By doing this, you can reduce the impact of price volatility and get a lower average for your investment.

Take Away

Just like most things in life, the crypto market also has its ups and downs. And if the current bear market has made your crypto portfolio bloody red, don’t panic. You’ll see longer greens, as it has always been.

In the meantime, try the following tips to help you take advantage of a down crypto market and tame the bear.

Also: Easy Bitcoin Trading – Top BTC Trading Tips that You Should Learn