State Farm: Top 5 Insurance and Financial Services You Need to Know About

State Farm is one of the largest and most trusted providers of insurance and financial services in the United States. Whether you’re in need of auto insurance, home insurance, savings accounts, or investment options, State Farm offers comprehensive solutions to meet your needs. In this article, we’ll dive into the services provided by State Farm and how they can help secure your financial future.

This article was written by the E Helper Team, offering an in-depth overview of State Farm’s insurance services, including auto, home insurance, savings accounts, and investment options

State Farm: Comprehensive Insurance and Financial Services for You

State Farm offers a wide range of services designed to protect individuals and families. From affordable auto insurance to flexible home insurance and investment solutions, their offerings ensure comprehensive coverage. In this article, we’ll explore these services in more detail, providing you with the information necessary to make informed decisions about your insurance and financial planning.

State Farm: Trusted Auto Insurance for Your Peace of Mind

State Farm is a leader in providing affordable and reliable auto insurance. With customizable plans that suit a wide range of drivers, State Farm’s auto insurance options can protect you and your vehicle in the event of an accident or damage. The company offers a variety of coverage options, including liability, collision, and comprehensive coverage. With discounts for safe driving and multi-policy holders, State Farm makes it easier to secure the protection you need.

Home Insurance: Protecting Your Most Valuable Asset

When it comes to home insurance, State Farm provides a wide array of coverage options that protect your home and personal belongings. Whether you own or rent, State Farm’s policies cover damage caused by natural disasters, theft, and accidents. The flexible plans allow you to customize your coverage to meet your needs, with options for additional protection against specific threats like flooding or earthquakes.

Savings Accounts: Secure Your Future with State Farm

State Farm also offers various savings accounts to help you grow your wealth. Their high-yield savings accounts provide competitive interest rates, enabling you to save for future goals like buying a home or retirement. With easy online access through the State Farm mobile app, managing your savings has never been simpler. Whether you’re saving for the short term or long term, State Farm’s savings options can help you build a secure financial foundation.

Investment Options: Grow Your Wealth with State Farm

State Farm provides a range of investment options that allow you to build and diversify your portfolio. From mutual funds to retirement accounts, they offer a variety of solutions to help you plan for the future. Whether you’re new to investing or an experienced investor, State Farm’s financial advisors are there to guide you in making informed decisions. Their State Farm Investment Planning App helps you track your investments, making it easier to monitor your progress.

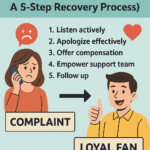

Claims Process: Simplifying the Claims Experience

Filing a claim with State Farm is straightforward and efficient, thanks to their streamlined claims process. Whether it’s for auto, home, or life insurance, State Farm makes it easy to submit a claim online or through the mobile app. The company prides itself on its customer service and quick response times, ensuring that you get the assistance you need when it matters most.

Member Benefits: The Advantage of Choosing State Farm

Choosing State Farm means you get access to a range of benefits beyond just insurance. From discounts on multiple policies to personalized financial advice, being a State Farm member can provide substantial savings and peace of mind. Their comprehensive services, including investment options and retirement planning, ensure that your financial future is in good hands.

Commonly Asked Questions About State Farm’s Services

What types of auto insurance does State Farm offer?

State Farm offers various auto insurance policies, including liability, collision, comprehensive, and uninsured motorist coverage, catering to a variety of drivers’ needs.

How can I get a discount on my home insurance policy with State Farm?

You can qualify for discounts on home insurance by bundling policies, installing home security systems, and maintaining a good claims history with State Farm.

Are there any fees associated with State Farm’s savings accounts?

State Farm’s savings accounts typically have low or no fees, making them a cost-effective way to save for your goals. Their competitive interest rates help you earn more on your savings.

How do I start investing with State Farm?

State Farm provides an array of investment options through their financial advisors. Whether you’re interested in mutual funds, IRAs, or other products, State Farm can guide you in building a diverse portfolio.

How do I file a claim with State Farm?

State Farm’s claims process can be done easily online or via their mobile app. You’ll be able to track your claim’s progress and receive updates every step of the way.

Conclusion: Why State Farm is Your Go-To for Insurance and Financial Solutions

In conclusion, State Farm offers an impressive array of services that provide both insurance protection and financial planning. From auto insurance to home insurance, savings accounts, investment options, and a simple claims process, State Farm is a trusted name in the insurance industry. Whether you’re looking for coverage, financial advice, or a way to save for your future, State Farm offers reliable, customer-focused solutions that can help you meet your financial goals.

Discover more about the exclusive benefits and services offered by Navy Federal in our detailed guide. Learn how it compares to other financial institutions and enhances your banking experience!