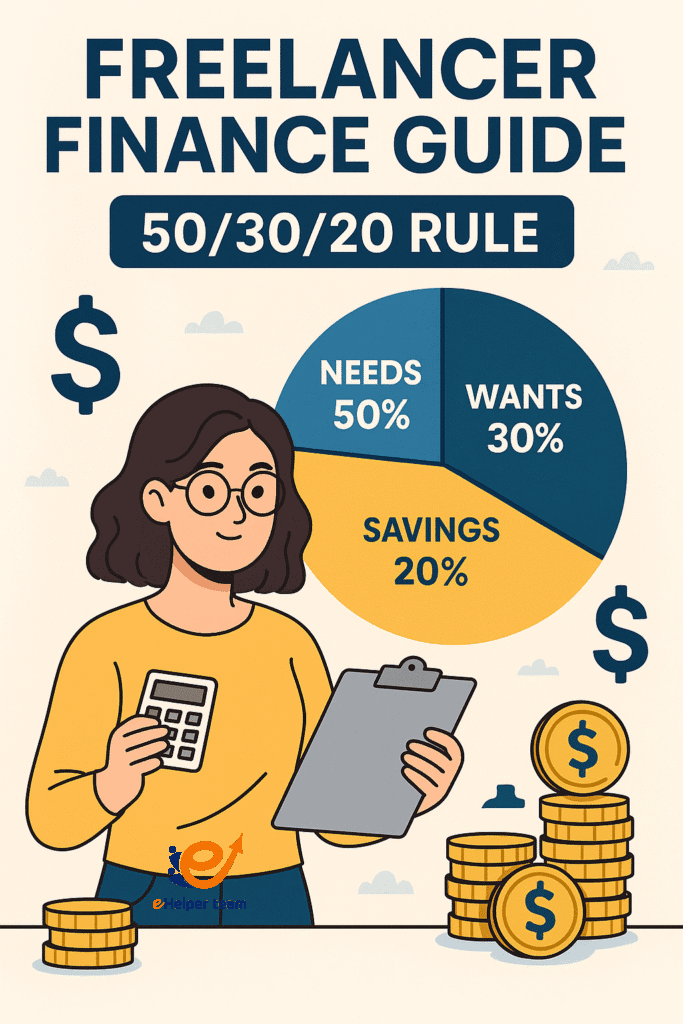

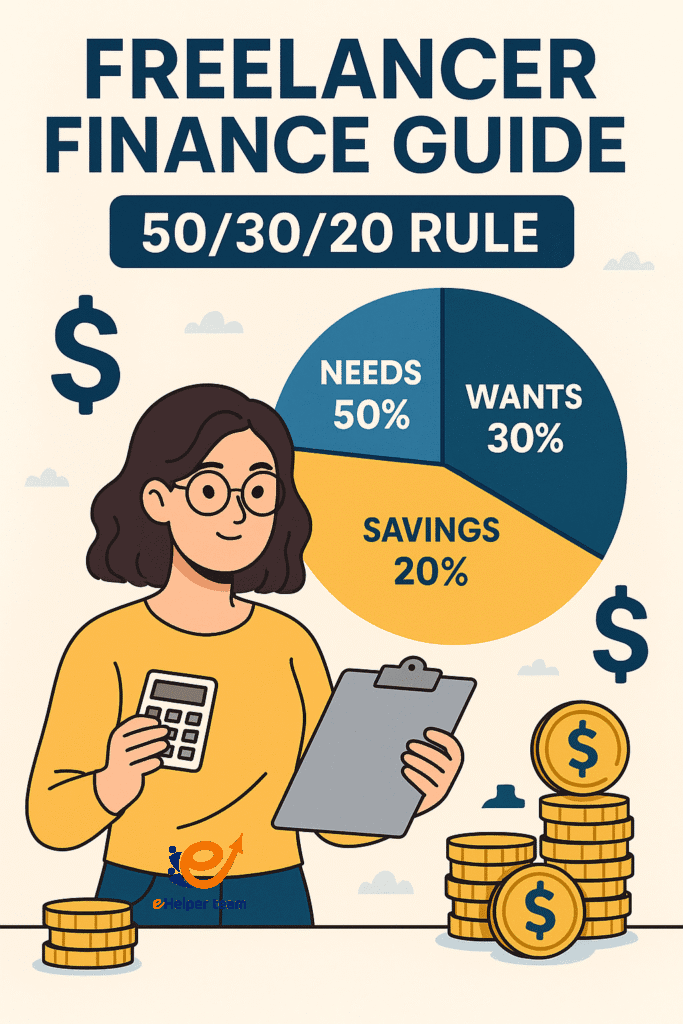

Freelancer Finance Guide: A Simple Plan Using the 50/30/20 Rule

Freelancer finance guide—have you ever stopped and asked yourself if you’re managing your income effectively as a freelancer? Without a regular paycheck, monthly deductions, or employer-covered taxes, freelancing puts the full weight of financial planning squarely on your shoulders. Are you prepared?

Imagine earning $4,000 this month and $900 next. How do you budget without going broke or blowing your savings? How do you separate personal fun from business necessities when it all flows into the same account? Do you feel anxious every tax season, unsure whether you’ve saved enough? The reality is, most freelancers wrestle with these same questions every single day.

That’s why this simple but powerful framework—the 50/30/20 rule—could be the clarity you’re looking for. When paired with smart income strategies like finding consistent freelance gigs online, you can finally gain control over your finances, plan ahead, and build true stability in your freelance journey.

Understanding the 50/30/20 Rule for Freelancers

The 50/30/20 rule isn’t new, but it’s a game changer for freelancers. It breaks your after-tax income into three essential categories:

50% for needs: Rent, utilities, groceries, insurance

30% for wants: Entertainment, hobbies, subscriptions

20% for savings and debt repayment

This framework helps you make decisions with structure. Even if your income varies, your plan doesn’t have to.

Adapting the Rule to an Unpredictable Income

Freelancers rarely earn the same amount every month. That’s why it’s essential to budget based on your lowest average income over the past six months. This creates a buffer. Any earnings above that baseline can go toward savings, investments, or major purchases.

Start with a core budget tied to your lowest earning month, then build flexibility for higher-earning periods.

How to Budget with Irregular Income

Budgeting with an unstable income stream requires foresight, discipline, and smart planning.

Establish a Base Budget

Use your lowest month’s earnings as the foundation. Allocate 50% of that to essentials, 30% to personal expenses, and 20% to savings. Then maintain this structure even when you earn more.

Create Buffer Accounts

When you earn more than expected, distribute the extra:

Add to an emergency fund

Pay off high-interest debt

Invest in business growth

This method keeps your lifestyle stable while building financial resilience. It’s one of the most effective techniques for mastering how to budget with irregular income.

Saving for Taxes: What Freelancers Must Know

If you’ve ever been hit with an unexpected tax bill, you know how crucial saving for taxes is. Unlike salaried workers, no one withholds taxes from your income—you must do it yourself.

How Much Should You Save?

Experts recommend setting aside 25% to 30% of your total freelance income for taxes. Open a dedicated savings account and transfer the amount immediately after each client payment.

Quarterly Tax Payments

If you’re based in the US or UK, you’re likely required to make estimated quarterly tax payments. Missing these can lead to penalties and interest charges. Automating your transfers helps ensure you’re always prepared.

Business vs Personal Expenses: Know the Difference

Many freelancers blur the lines between work-related spending and lifestyle costs. This can lead to budgeting issues, tax complications, and overspending.

Why It Matters

Understanding the distinction between business vs personal expenses helps with:

Accurate tax reporting

Cash flow clarity

Smarter investment in your work

How to Separate Finances

Use dedicated business banking accounts

Track each expense using accounting software

Categorize transactions clearly in real-time

This separation also simplifies bookkeeping, especially when using platforms like FreshBooks or QuickBooks.

Exploring the Profit First Method

While the 50/30/20 rule focuses on personal budgeting, the profit first method is a business-oriented approach. It prioritizes profit by making it the first allocation from any income received.

Key Concept

Instead of the usual:

Revenue – Expenses = Profit

You flip the formula:

Revenue – Profit = Expenses

This mindset ensures you always take your cut before spending on business costs. It’s particularly effective for freelancers who want to reinvest in themselves while maintaining financial discipline.

Which System Is Better?

Both have value:

Use 50/30/20 for personal income management

Apply the profit first method to your freelance business model

Together, they offer a full-spectrum solution for managing your money.

Income Growth Strategies to Support Your Budgeting Framework

To make budgeting easier, you need reliable income streams. These three resources offer practical strategies to help you earn more, consistently.

Build a Reliable Freelance Career

Check out this full guide to starting freelance work online, It walks you through skills selection, platform options, and client acquisition—all crucial to creating steady income that makes budgeting possible.

Become a Top-Rated Freelancer

Want better clients and higher pay? Learn how to earn the Top Rated badge on Upwork by mastering client communication, meeting deadlines, and refining your service offerings.

Monetize Social Media Management

Social media isn’t just a scrolling habit—it’s a profitable skill. This social media management guide shows how to land local clients and turn Facebook and Instagram into a revenue stream.

Real-World Case Study: From Chaos to Control

Maria is a freelance graphic designer who struggled with financial instability. Her income fluctuated between $1,200 and $4,000 per month. After applying the freelancer finance guide, she:

Tracked her six-month average and used the lowest ($1,200) as her base budget

Used the 50/30/20 rule to allocate spending categories

Opened separate accounts for taxes, savings, and expenses

Followed the profit first method through a dedicated structure

Within four months, Maria built a $3,000 emergency fund and started paying herself a consistent monthly “salary” regardless of her actual income.

Her confidence grew. So did her business.

How to Create a Steady Monthly Salary from Irregular Freelance Income

One of the toughest parts of freelancing is not knowing exactly how much you’ll earn each month. Some months bring in thousands; others barely cover the basics. This inconsistency can make it nearly impossible to stick to a budget, save regularly, or feel financially secure.

But there’s a solution: treat your freelance income like a business and pay yourself a fixed monthly salary. Here’s how.

1. Calculate Your Monthly Average Income

Review your income over the past 6–12 months. Note your:

Lowest-earning month

Highest-earning month

Monthly average

Let’s say:

Lowest: $1,200

Highest: $3,500

Average: $2,200

Use this average as your financial baseline.

2. Choose a Fixed Monthly “Salary”

Pick a realistic salary slightly below your average—say, $2,000.

Even if you earn $3,000, only transfer $2,000 to your personal account. The rest stays in reserve for low-income months.

3. Separate Business and Personal Accounts

Have at least two bank accounts:

One for receiving client payments

One for paying your monthly “salary” to yourself

This structure creates psychological and financial clarity.

4. Build a Buffer for Lean Months

In high-income months, the extra sits untouched. In slow months, pull from that buffer so you still “get paid” on time.

You’re essentially building a personal payroll system.

5. Reassess Every 6 Months

As your income grows, review your salary and adjust it conservatively. Always keep a 1–2 month buffer in your “business” account before increasing your pay.

Frequently Asked Questions (FAQ)

1.How much should I set aside for taxes as a freelancer?

Save 25–30% of every payment you receive. Place it in a separate account and make quarterly payments as needed.

2.Can I still budget if my income is inconsistent?

Absolutely. Use your lowest average income as the foundation, and stick to it consistently. Then save or invest any additional income from high months.

3.What’s the difference between business and personal expenses?

Business expenses are directly tied to earning income—software, marketing, client meetings. Personal expenses include groceries, rent, and personal subscriptions.

4.Should I use the profit first method as a freelancer?

Yes, especially if you’re running a growing freelance business. It ensures you’re always taking your share of income before spending on business costs.

5.What apps or tools should I use to manage my money?

Use Mint or YNAB for budgeting, and QuickBooks or FreshBooks for expense tracking and invoicing. They make financial planning more efficient.

Conclusion

Being a freelancer offers freedom, but with freedom comes responsibility—especially financial. A well-structured approach using the freelancer finance guide, supported by the 50/30/20 rule and business-first tools like the profit first method, can make all the difference.

Whether you’re just starting or scaling up, follow the strategies shared here to build stability, confidence, and long-term financial health.