Best Payment Gateway for Ecommerce – Stripe, PayPal & Square Guide

Have you ever wondered which is truly the best payment gateway for ecommerce in today’s competitive online market? With so many digital payment options available, choosing the right one can feel like trying to pick the fastest horse in a race you’ve never watched. Stripe, PayPal, and Square each promise secure transactions, competitive fees, and easy integration, but which one actually delivers the most value for your online store?

This decision goes far beyond just processing payments. The payment gateway you select impacts your transaction fees, customer trust, ease of integration, and even your ability to accept international payments. For a US or UK-based business owner, understanding how these platforms compare can mean the difference between seamless sales and frustrating checkout drop-offs.

In this detailed guide, we’ll explore transaction fees comparison, chargeback policies, integration ease, and more. You’ll see side-by-side data, practical insights, and expert advice to help you make a confident choice. Whether you run a small boutique store or a fast-growing ecommerce brand, by the end, you’ll know exactly which gateway aligns with your goals.

Why Your Choice of Payment Gateway Matters

The payment gateway is more than just a technical tool—it’s the bridge between your customer’s wallet and your store’s revenue. Selecting the wrong one can lead to higher costs, limited payment methods, and even lost sales due to failed transactions.

Key Functions of a Payment Gateway

Securely processes credit and debit card payments

Supports alternative payment methods like digital wallets

Handles international currency conversions

Provides fraud detection and chargeback handling

Stripe, PayPal, and Square – Quick Overview

| Feature | Stripe | PayPal | Square |

|---|---|---|---|

| Founded | 2010 | 1998 | 2009 |

| Supported Countries | 47+ | 200+ | US, CA, JP, AU, UK |

| Best For | Developers, global reach | Broad audience, trust factor | In-person + online sales |

| Average Fees | 2.9% + 30¢ | 2.9% + 30¢ | 2.6% + 10¢ |

| Integration | API-heavy, flexible | Easy plugins | Simple POS + ecommerce tools |

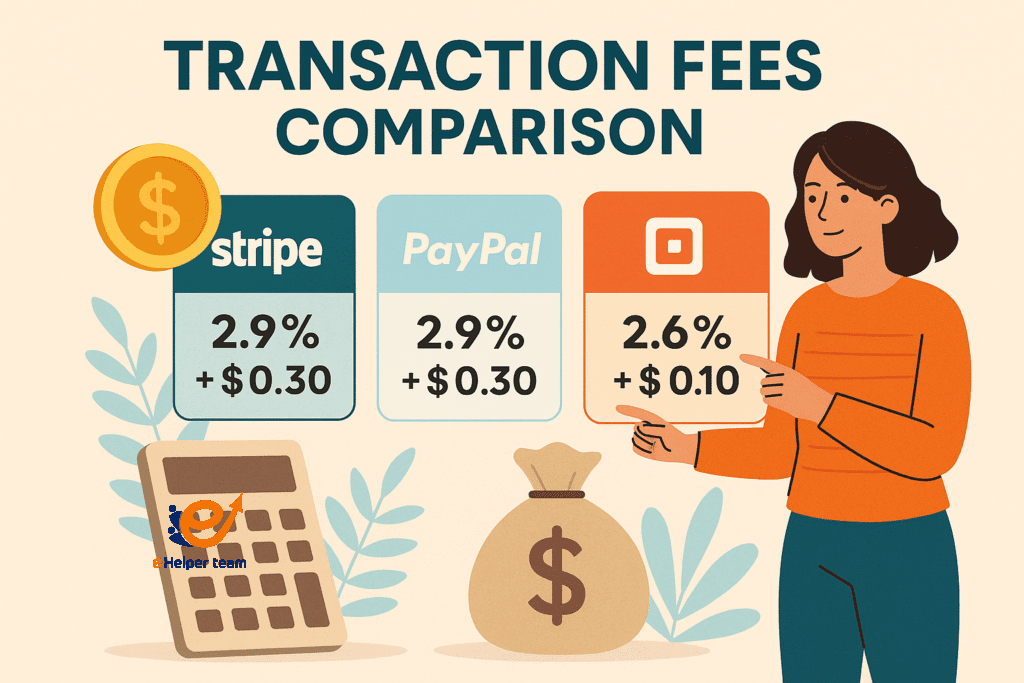

Transaction Fees Comparison

When it comes to transaction fees comparison, the differences may seem small on paper but can add up significantly over time.

Stripe: 2.9% + $0.30 per transaction for US cards, higher for international

PayPal: Similar to Stripe, but may add currency conversion fees

Square: 2.6% + $0.10 for card-present transactions, slightly higher for online

For a store processing $50,000 per month, even a 0.3% difference can save hundreds in fees annually.

Chargeback Policies

Chargebacks can be costly, both financially and reputationally.

- Stripe: Highly customizable API—best for developers and businesses needing unique checkout flows

PayPal: Simple plugin installation for platforms like Shopify, WooCommerce, and Magento

Square: Built-in POS with smooth ecommerce extensions, ideal for hybrid sellers

For example, if you’re comparing Shopify vs WooCommerce for your online store, you’ll find each supports all three gateways but with different levels of customization (learn more here).

International Payments

For businesses serving customers abroad, international payments are critical.

Stripe: Supports over 135 currencies, strong multi-currency features

PayPal: Available in 200+ countries, but fees for cross-border payments can be steep

Square: More limited in international reach—best suited for domestic-focused businesses

Security and Fraud Protection

All three gateways meet PCI compliance standards, but they differ in advanced fraud detection tools. Stripe offers machine learning–based detection, PayPal relies on its massive network data, and Square uses integrated seller protections.

Hosting and Infrastructure Considerations

Your hosting provider also affects payment gateway performance. Poor hosting can cause checkout lag, increasing cart abandonment. Choosing one of the top global hosting companies can ensure faster load times and better uptime for smoother transactions.

Case Study – Small Retailer Switching Gateways

A US-based handmade jewelry seller switched from PayPal to Stripe to avoid higher currency conversion fees when selling to Europe. Within three months, checkout completion rates rose by 8% and chargebacks dropped by 12%.

Final Recommendations

Best for Global Reach: Stripe

Best for Brand Trust: PayPal

Best for Hybrid Sales: Square

Additional Resources Before Deciding

If you also market products on social media platforms, using a link-in-bio tool that integrates payments can make your checkout process even more seamless.

How Payment Gateways Impact Customer Experience

Your payment gateway plays a direct role in shaping the checkout journey. Beyond processing transactions, it influences how your customers perceive your brand. A fast, seamless, and trustworthy checkout boosts conversions, while friction or unclear payment processes can lead to abandoned carts.

Key customer-experience factors to consider:

Checkout speed: Gateways with fewer steps keep customers engaged until purchase completion.

Mobile optimization: With mobile commerce now representing over 50% of online sales, your gateway must work flawlessly on smartphones and tablets.

Localized payment options: Customers in different regions may prefer certain methods—such as iDEAL in the Netherlands or Alipay in China.

A US-based ecommerce store expanding to the EU might notice a drop in conversions if their payment gateway doesn’t support these local options, even if their main credit card processing works perfectly.

Comparing Payout Schedules

Even if two gateways charge the same transaction fee, their payout schedules can make a significant difference to your cash flow.

Stripe: Standard payouts within 2 business days; instant payouts available for a fee.

PayPal: Instant access to funds in your PayPal balance, with withdrawals to a bank taking 1–2 days.

Square: Same-day deposits for a small fee, or next-business-day standard payouts.

For businesses with thin margins, the ability to access funds quickly can be critical for paying suppliers and managing operations smoothly.

Hidden Costs to Watch Out For

While most business owners focus on transaction fees, other charges can quietly erode profits:

Currency conversion fees when selling internationally.

Refund fees that may not be fully reimbursed.

Premium feature costs, such as advanced fraud protection or additional payment methods.

For example, PayPal’s standard refund policy no longer returns the original transaction fee, meaning frequent returns can increase your effective processing cost.

Platform Compatibility

Before committing to a gateway, it’s essential to ensure full compatibility with your ecommerce platform. While Shopify, WooCommerce, and BigCommerce support all three gateways, the level of customization varies.

Some platforms integrate deeply with Stripe’s API, enabling features like dynamic currency conversion, while others might only offer basic functionality. Similarly, Square may offer tighter POS integration for hybrid businesses that sell both online and offline.

Scalability for Growing Businesses

A gateway that works for a small boutique may struggle to support the needs of a growing brand. Scalability involves:

Processing high volumes without performance slowdowns

Advanced analytics and reporting to understand sales trends

Flexible API access for integrating with inventory and CRM systems

Stripe is often favored by high-growth startups because of its developer tools, while PayPal’s ecosystem appeals to businesses prioritizing brand recognition among consumers.

Real-World Usage Scenarios

To illustrate, consider these three hypothetical ecommerce businesses:

Small Handmade Goods Store (Domestic Only): Likely to benefit from Square’s lower in-person fees and simple integration.

Mid-Size Clothing Brand Selling Internationally: Stripe’s multi-currency support makes cross-border sales seamless.

Digital Product Creator: PayPal’s instant payouts and global reach cater to customers worldwide, reducing payment friction.

Legal and Compliance Considerations

When choosing a gateway, merchants must also consider compliance obligations:

PCI-DSS compliance ensures secure card handling.

GDPR compliance is crucial for UK and EU transactions.

Local tax collection requirements vary by region and may require integration with your payment gateway.

Failing to meet these standards can result in fines or even loss of merchant account privileges.

Marketing and Upselling Opportunities

Some gateways offer tools that can indirectly boost revenue:

One-click upsells during checkout.

Stored payment methods for faster repeat purchases.

Abandoned cart recovery integrations that remind customers to complete purchases.

By selecting a gateway with these features, you can improve both your customer retention rate and your average order value.

Support and Reliability

No matter how feature-rich a gateway is, poor customer support can be a dealbreaker.

Stripe: Offers 24/7 chat and email support, with priority phone support for premium accounts.

PayPal: Phone and message center support, though response times can vary.

Square: Known for responsive phone and live chat support, especially for US-based sellers.

FAQs

Q1: Which payment gateway is cheapest for small businesses?

It depends on your sales volume and transaction types. Square often has lower fees for in-person sales, while Stripe may be better for online international sales.

Q2: Can I use multiple payment gateways at once?

Yes, many ecommerce platforms allow multiple gateways so customers can choose their preferred payment method.

Q3: Do all three gateways support recurring payments?

Yes, Stripe, PayPal, and Square all offer subscription billing, though Stripe provides the most customization for developers.

Q4: How quickly can I get paid?

Stripe and Square usually pay out in 2 business days, while PayPal often offers instant transfers (for a fee).

Q5: Which is best for selling digital products?

Stripe and PayPal both excel in digital goods transactions, with strong fraud protection and easy integration with popular platforms.

Conclusion

Choosing the best payment gateway for ecommerce is not just about comparing fees—it’s about aligning the right platform with your business model, growth plans, and customer expectations. Stripe excels in flexibility and international reach, PayPal shines in consumer trust and instant payouts, while Square offers a powerful hybrid solution for sellers operating both online and in person.

By evaluating transaction fees comparison, ease of integration, international payment capabilities, and chargeback policies, you can make a data-driven decision that benefits both your bottom line and your customers’ experience.