What is Payoneer bank and history of it

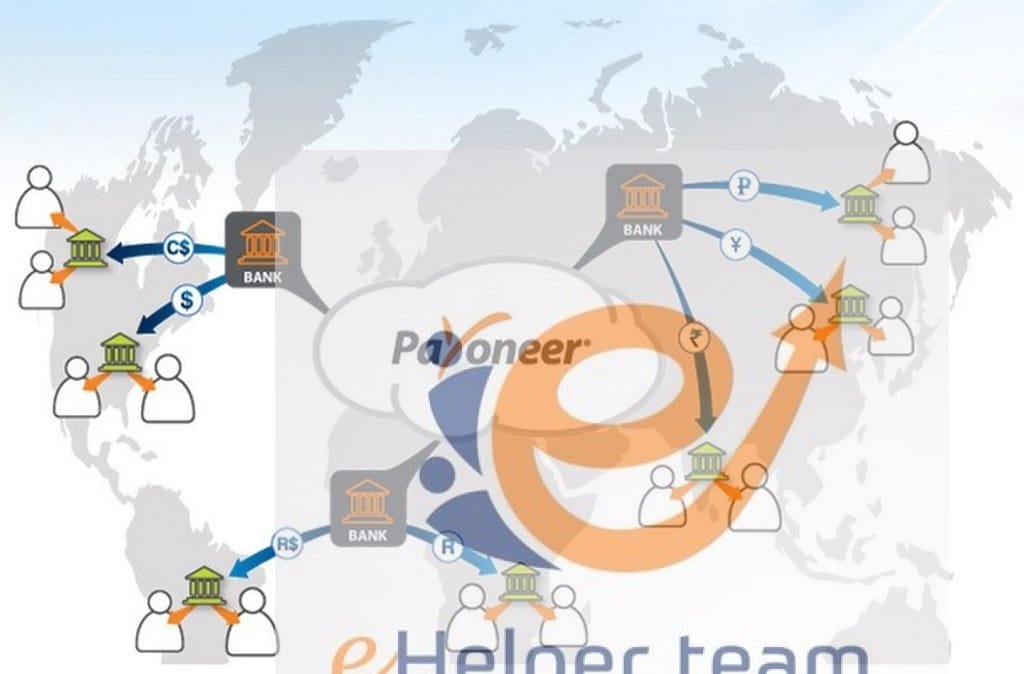

A Payoneer bank is a monetary administration organization giving advanced installment administrations and online cash moves.

Record holders can send and get assets to their ledger, Payoneer e-wallet, or a reloadable MasterCard pre-loaded charge card that can be utilized on the web or at retail locations.

The organization is represented considerable authority in encouraging B2B installments across the outskirts.

It conveys traverse 150 neighborhood monetary forms, including cross-fringe wire moves, online installments, and check card refillable administrations.

Organizations, for example, Airbnb, Amazon, Google, and Upwork use

Payoneer bank to send overall mass payouts.

What is Payoneer bank?

It is additionally utilized by eCommerce commercial centers like Envato and works with promotion systems to interface these organizations with distributors outside their base camp.

Payoneer works with an assortment of organizations and independent business sectors in the substance creation space.

The New York City base camp of the organization.

1-You will get a MasterCard pre-loaded check card when you join the Payoneer site.

You’ll additionally get a MasterCard – connected online record. You can deal with your own record subtleties and screen your parity and exchange records also.

2-The card costs $ 29.95 every year, which is deducted naturally from your parity. There’s no compelling reason to stress over month-to-month support charges.

3-You can get immediate store installments through the US Payment Service in the event that you sell things at US-based organizations, for example, Amazon.

The exchange charge is just 1 percent of the aggregate sum, which implies that for a $ 1,000 installment, you just need to pay $ 10.

At that point, you legitimately get the installment in your record. You don’t need to pay luxurious expenses with this strategy, nor do you need to curve your thumbs standing by to clear up a global check.

4-With Payoneer’s Global Bank Transfer Service, organizations can utilize nearby bank moves, wire moves, and US ACH to send assets around the globe. In more than 200 nations and more than 90 distinct monetary standards, this works.

Payoneer bank account

5-Anyone on the planet who utilizes a MasterCard or a Visa can pay you. The greatest installment for a solitary exchange is $ 1000, and per installment exchange, there is a little preparing expense.

6-You would then be able to pull back your cash from any ATM on the planet where you can see the MasterCard logo when you get your cash in your record. Around the world, there are at any rate 1,000,000 of these ATMs. It will cost you three dollars for every exchange, however.

7-You can get your installments online in US dollars on the off chance that you are managing Payoneer accomplice organizations. There is no expense required for the vast majority of these accomplice organizations, and you will get your installments in two days. Yet, in case you’re willing to pay a base charge ($ 2.50), you can quicken the cycle and get your cash in an hour or somewhere in the vicinity.

8-You are not restricted to the online utilization of Payoneer. You can likewise utilize it in retail shops to pay for your buys. It works simply like some other check card, so you can’t spend more cash for you than you have. There is no extra charge added to your buy on the off chance that you utilize your Payoneer card thusly.

Furthermore, more or less, that is Payoneer: the most extreme accommodation at sensible expenses for your online exchanges.

What is Payoneer? Payoneer is an innovative cross-periphery portion stage that interfaces associations and specialists across countries and financial structures. Payoneer engages a large number of associations and specialists from more than 200 countries to contact new groups by empowering predictable, cross-periphery portions. An immense number of driving associations including Google, Airbnb, Fiverr, and Getty Images rely upon Payoneer’s mass payout organizations. Payoneer acts in India as an online portion passage master center (as supported by the Reserve Bank of India) (“OPGSP”) to empower certain portion organizations.

read more: Differences between Payoneer and PayPal

History of Payoneer

- Payoneer was established in 2005 with $2 million in seed subsidizing from the originator and afterward CEO Yuval Tal and other private financial specialists.

- In August 2016, the firm included a computerized tax document administration in its mass payout offering.

- In October 2016, the organization raised $180 million from Technology Crossover Ventures, carrying the complete subsidizing to $234 million.

- also, In 2017, China Broadband Capital (CBC) put resources into Payoneer.

- In 2017 and 2018, Payoneer was named CNBC’s 40th and thirteenth most troublesome organization, individually.

- In 2018, the previous boss financial specialist of Israel, Yoel Naveh, joined the organization to lead Payoneer’s working capital division.

- Payoneer extended its Capital Advance assistance in mid-2019, explicitly for web-based business vendors in the United States, which permits vendors selling on web stages, for example, Amazon and Walmart prompt admittance to working capital.

- In 2019, Payoneer collaborated with outsourcing stage Toptal to encourage cross-outskirt installments, permitting more proficient development of wages among businesses and telecommuters.

- Payoneer additionally got authorization as an Electronic Money Institution from the Central Bank of Ireland for clients in EEU.

- In 2019, Payoneer recruited FT Partners to help encourage the extension of the organization and an extra round of private financing.

- In December 2019, Payoneer obtained reptile, a German installment organization platform. The securing permits Payoneer, just because, to offer vendor administrations and shopper installment acknowledgment notwithstanding the B2B administrations they have been giving since its origin.

- Daniel Smeds established and runs reptile, and its staff of 75, which will keep on working as a free gathering based out of their present HQ in Munich while additionally working for Payoneer.

- In February 2020, the organization was remembered for the Forbes Fintech 50: The Most Innovative Fintech Companies in 2020.

Services of Payoneer

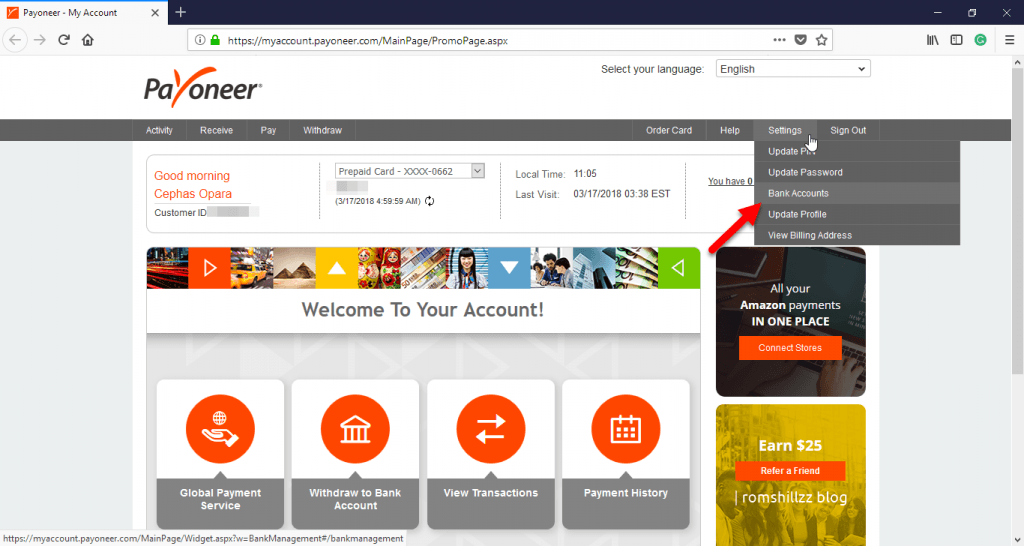

- Record holders can send and get assets into their financial balance, Payoneer e-wallet, or onto a re-loadable paid ahead of time MasterCard check card that can be utilized on the web or at retail locations, in our site was talked about How to create a Payoneer account

- The organization represents considerable authority in encouraging cross-outskirt B2B installments.

- It gives cross-fringe exchanges in 200 nations and domains and in excess of 150 neighborhood monetary standards, with its cross outskirt wire moves, online installments, and refillable charge card administrations.

- In the substance creation space, Payoneer works with Getty Images, iStock, Pond5, and others just as in the independent commercial center.

- Payoneer has a client care group with 320 workers who uphold 4 million clients in 70 dialects, working in 150 unique monetary forms.

- In October 2019, the organization propelled a help focused on little and medium estimated organizations to send installments anyplace on the planet rapidly and inexpensively.

read more: Overview about Payoneer bank