Payoneer bank was established in 2005 with a central station in New York. They are an overall Member Service Provider of MasterCard. A portion of the organizations that utilize Payoneer incorporates Google, Airbnb, iStock, and Fiverr.

Backing for more than 200 nations and 150 monetary forms, and the capacity to legitimately pull back assets with check cards that they give. Payoneer charges a level of $3 expense for each move.

When Payoneer bank doesn’t work

In the event that you are searching for cash move administrations for sending or accepting assets among loved ones, or as an essential method to pay for things utilizing their pre-loaded charge card,

Payoneer isn’t for you. Payoneer just acknowledges business exchanges and is about installments.

Likewise, it has limits on specific exchanges.

In the event of installments for installment demands or the ones started by other Payoneer clients, there is a restriction of 15,000 USD/15,000 EUR/15,000 GBP if there should arise an occurrence of Visa installments and 15,000 USD with eCheck.

For installments from other Payoneer clients, there is a month-to-month furthest reach of 100,000 USD. In the event that you expect to make bigger exchanges, at that point you may need to investigate different suppliers.

Our Personal Experience

On the off chance that you need to get paid by commercial centers and global customers as though you had your own nearby record then you will need to understand this.

Payoneer bank has numerous bands to hop through to get a Global Payment.

This can feel super in the wake of surrendering duplicates of your ID to get “affirmed” you at that point need to give a wide range of proof that who consistently paying you, is really paying you

(despite the fact that Payoneer bank as of now has the cash by this point).

For our situation, this incorporated a receipt, the purpose behind the installment check, inquiries regarding the installment, and screenshots of record movement and the record indicating their location to make reference to the fundamental ones.

We comprehend that a great deal of this has to do with meeting guidelines and generally speaking, we think this is something worth being thankful for.

Yet, you can get an email saying, “We are sorry to illuminate you that your admittance to Payoneer’s Global Payment Service has been stopped”

and the cash they have from your customer or client gets returned.

The difficulty we have here isn’t that our capacity to utilize Payoneer was ended yet that there is no plan of action and no accommodating data.

This is only one experience and not disconnected from Payoneer bank, yet it makes every one of us sharp for you to know about what we found when we examined the audits.

Luckily, Payoneer bank additionally has some solid contenders you should think about.

read more: Overview of Payoneer bank

How accomplishes Payoneer Work?

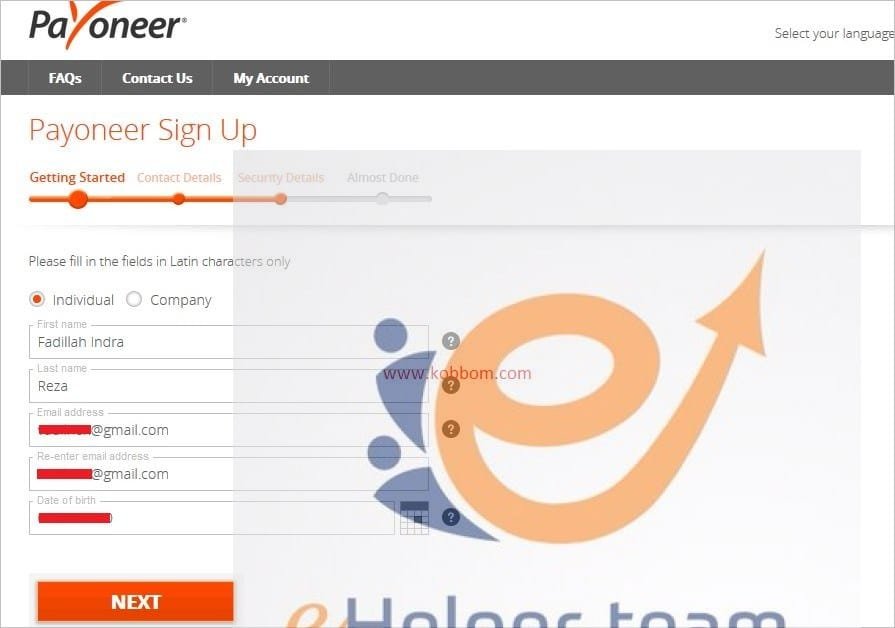

Creating a Payoneer Account

Snap “Join” on the Payoneer site, and you will be asked whether you are making a record for expert or individual use

Enter your own subtleties, for example, name, email address, date of birth, address, and telephone number.

Utilizing the email address as Payoneer username, enter a secret phrase

and pick a security answer and question Enter your record subtleties

Affirm your Payoneer account by tapping on the connection sent to your enrolled email.

As an extra safety effort, you will be asked to pick two greater security inquiries

Payoneer account will at that point complete a credit check. Confirming personality

and running credit checks may take as long as 2 days

When affirmed, you can begin mentioning and sending installments through Payoneer bank

Receiving Funds

There are two manners by which you can get assets through Payoneer:

When you use Payoneer bank to get paid by customers by sending them an installment demand, Payoneer bank sends them an email with subtleties of the installment

and the choices to pay you. You will get the assets in your Payoneer account within a couple of days relying upon the installment alternative utilized.

To get paid by commercial centers and organizations by bank move, Payoneer gives getting accounts that work like nearby records. Along these lines,

you can get neighborhood bank moves in nearby monetary standards. Installments that go to your accepting record are moved legitimately to your Payoneer account.

Other Payoneer clients can make business-related installments to you utilizing one of the numerous ways accessible to them contingent upon their qualifications.

On the off chance that you offer types of assistance through commercial centers, for example, Airbnb and Upwork, you can simply pick Payoneer as the installment technique and get paid.

Making Payments

At the point when you use Payoneer bank to pay another Payoneer bank, you don’t need to pay any charge and the equalization is moved from your record to theirs in no time

You can likewise utilize Payoneer to cause installments to the individuals who don’t utilize Payoneer.

You have to include their financial balance subtleties and make installments from your Payoneer bank record to their ledger legitimately.

The amount Does Payoneer Cost?

Opening a record with Payoneer is free. It offers different approaches to sending, getting cash, and handling cash. Given the multifaceted nature of their charge structure, we have separated and rearranged it into the primary ways you will need to utilize Payoneer. Thusly you can concentrate on what you will utilize Payoneer bank for and see what you will pay.

Making a Payment

Through ‘Make a Payment’, getting and making installments as a Payoneer client is free.

Paying Your Service Providers

With Payoneer bank, you can undoubtedly make installments to your specialists and other specialist organizations anyplace on the planet at exceptionally serious rates.

The charges are as per the following

check: 1%

Charge card: 3%

Nearby bank move: 1%

When making installments to the specialist organization, Payoneer lets you pick whether you need to pay the expense or give it to the beneficiary

. In the event that the specialist co-op is situated in an EEA nation, the expense is consequently charged to them.

Receiving Money

There are two manners by which you can get cash through Payoneer.

Global Payment Service

In the event that you have enlisted for the Global Payment Service of Payoneer, you will get getting represents euros (EUR), U.S. dollars (USD),

Japanese yens (JPY) and British pounds (GBP).

This lets you get various monetary standards. It resembles having a nearby financial balance in the UK, US, Canada, Japan, Mexico, and Australia.

For EUR, GBP, JPY, AUD, CAD, and MXN: No charges

For USD: 1% charge

Receive Payments from Customers

In the event that you utilize the charging administration to get installments by means of Payoneer bank, you should pay various expenses for installment by eCheck or Visa.

By means of eCheck (USD): 1% expense

By means of Mastercard (all monetary forms): 3% expense

Exchanging Currency

On the off chance that you have to trade starting with one cash and then onto the next, you should pay a 0.5% charge over the mid-market rate.

This expense is exceptionally serious and one of the fundamental reasons you may discover Payoneer bank is a decent approach.

Marketplaces and Networks

Payoneer is utilized by many driving commercial centers and outsourcing stages. These stages, including Upwork, Fiverr, and Airbnb set their own expenses for pulling back cash

. In this way, you have to check the rates with separate stages.

Transferring Money from Payoneer bank to a Bank Account

For pulling back cash, you should pay an alternate charge contingent upon whether you are pulling back assets in an alternate money or similar money.

For pulling back assets from a Payoneer record to a financial balance in alternate money, you should pay 2% over the interbank rate.

While the typical pace of 2% is far superior to a bank, you can click here for information exchange.

(opens another tab)

and get a VIP pace of 1.2% which is a lot nearer to what you would anticipate from a master cash move organization.

For pulling back cash into your financial balance in similar money, you should pay $1.50 for the exchange.

Using the Payoneer bank Prepaid Mastercard

On the off chance that you use Payoneer Mastercard to make a buy with money other than the card’s recorded cash.

The trade will occur at the Mastercard’s legitimate conversion scale.

Likewise, you will pay a cash transformation charge of up to 3.5%.

In the event that you are hoping to cause ordinary buys, we recommend a more serious swapping scale maybe from these pre-loaded cards.

How Fast is Payoneer bank?

Sending and accepting assets with your Payoneer account is practically the moment.

Exchanges with non-Payoneer records may take longer relying upon the installment techniques utilized.

Both worldwide and neighborhood move for withdrawal to your financial balance as a rule take 2-5 business days.

This implies, when you get the affirmation mail from Payoneer, it might take 2-5 days for the assets to arrive at your record.

Moves inside the US for the most part take 2-3 business days.

Client Reviews of Payoneer bank

Payoneer bank appreciates a score of 4.6 from over 12000+ audits on Trustpilot with the majority of the surveys being fantastic or extraordinary.

In any case, 6% are poor and awful audits (one and two stars).

The Real Deal

We filtered through 100s of audits to get a thought of what turned out badly and made individuals compose helpless surveys.

One thing we truly enjoyed about the Payoneer bank group was the manner in which they reacted to negative audits.

They have given consistent answers for all the issues and guaranteed them all the help they can give to improve their experience.

Here are the two most regular issues commentators confronted with Payoneer

Long-hanging tight occasions for client service: Some analysts have whined that they needed to hang tight for quite a while before they could connect with a live operator.

Be that as it may, we discovered there are different channels to contact client care

as opposed to standing by inconclusively for a live visit.

For better reaction times, Payoneer bank even suggests utilizing telephone, email, or web-based media stations.

Postponed or dropped installments: Sometimes, deferrals can happen because of the survey cycle or while making exchanges, which they need to do because of administrative prerequisites.

This bodes well, however simply wish

it was simpler in some way or another fix the issue.

For instance, at times, delays happened because of the client’s failure to give important archives however in different cases the issues appear to be “undisclosed”.

Is Your Money Safe with Payoneer bank?

Payoneer bank is a genuine, completely controlled US organization enlisted as a US Money Service Business (MSB).

They have additionally been in activity since 2005, and are guaranteed at a PCI Level 1 Data Security Standard which implies they have to maintain an exclusive expectation of security on their system and frameworks.

Aside from the electronic assurance, they have executed systems to guarantee physical security

and uprightness of all information.

They consistently update their conventions to forestall information misfortunes because of robbery, fire or mishaps.

All passages are secured by infection location frameworks and firewalls to forestall hacking and altering.

Their IT frameworks go through mandatory far-reaching yearly PCI reviews.

Every exchange is defended by the refined enemy of hacking methods and firewalls so as to forestall extortion, phishing experiences, wholesale fraud, and different kinds of assaults.

They send email warnings about pretty much all business exchanges and record changes.

Any unordinary exchange is likewise promptly advised through email.

This causes you to keep total track of your record.

While we are not security specialists using any and all means, we feel guaranteed that your cash is sheltered as sensibly conceivable at Payoneer.

At long last, Is Payoneer bank right for you?

Payoneer bank is a convincing decision for specialists, experts, and private venture searching

for a straightforward savvy approach to sending and acknowledging installments.

Utilizing Payoneer’s administration bodes well for any individual who needs to break liberated

from absurd charges and simply needs help that does the fundamentals truly well.

The amount they will spare you relies upon many cost factors (above),

yet they are very likely going to set aside your cash contrasted with old-school banking.

Snap here to information exchange (opens another tab) and get a VIP pace of 1.2% for moves from your Payoneer record to your ledger (regularly 2%).

Payoneer bank can likewise give a paid ahead-of-time Mastercard which can make spending (the cash you make) truly simple however there are more savvy cards you should consider.

Generally speaking, their evaluation of their essential capacity (getting paid and paying others) is serious.

For some, individuals working in a more worldwide economy Payoneer bank are a long late, and welcome alternative, accepting you don’t get your entrance ceased.