Forex Trading Strategies on AvaTrade: A Structured Guide for Smarter Trading Decisions

Forex Trading Strategies on AvaTrade are increasingly attracting traders who want more than just basic market access. Why are so many beginners and experienced traders choosing AvaTrade to build their trading plans? Is it the platform’s flexibility, its range of trading tools, or the structured environment that supports both manual and automated decision-making? These questions are often asked by traders who want consistency, transparency, and long-term potential in the forex market.

When traders explore Forex Trading Strategies on AvaTrade, they usually want to understand how strategies can be applied in real market conditions. Can technical analysis really improve entry and exit timing? How important is risk management when trading leveraged products? And does AvaTrade provide the right balance between simplicity for beginners and depth for professionals? These considerations shape how traders approach the market and define their trading behavior.

For anyone serious about improving performance, Forex Trading Strategies on AvaTrade offer a framework rather than random decision-making. A strategy helps traders stay disciplined, reduce emotional reactions, and adapt to changing market conditions. In this article, we will explore how AvaTrade supports structured trading, how strategies are developed, and how traders can use professional tools to trade with greater confidence.

Why Strategic Trading Matters in the Forex Market

Trading without a strategy often leads to inconsistent results. A clear plan helps traders define when to enter a trade, when to exit, and how much risk to take.

Key Benefits of Strategic Trading

Improved decision-making discipline

Reduced emotional trading

Better capital preservation

Clear performance evaluation

Successful traders rely on market structure analysis, price action patterns, and trend identification rather than guesswork. AvaTrade provides an environment where these elements can be applied efficiently.

Overview of AvaTrade’s Trading Environment

AvaTrade offers a professional yet accessible trading ecosystem designed to support different trading styles. From short-term traders to long-term investors, the platform adapts to various levels of experience.

Core Trading Features

Advanced charting tools

Multiple order types

Customizable indicators

Stable trade execution

The platform supports both discretionary trading and system-based trading, allowing traders to grow and refine their approach over time.

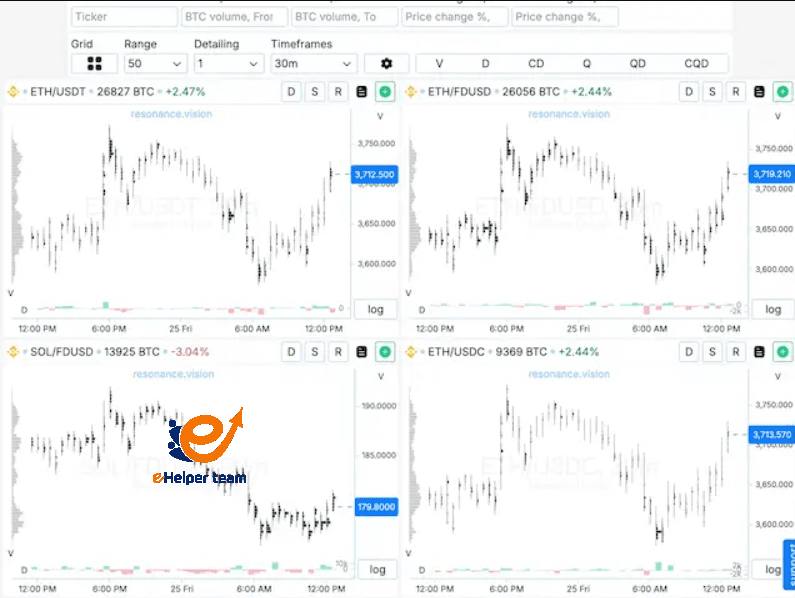

Understanding Market Analysis on AvaTrade

Market analysis is the foundation of any trading strategy. On AvaTrade, traders can combine different analytical methods to gain clearer market insights.

Technical Analysis

Technical analysis focuses on price movements, historical data, and chart patterns. Commonly used tools include:

Support and resistance levels

Moving averages

Momentum indicators

Trend channels

These tools help traders identify potential entry and exit points with greater accuracy.

Fundamental Analysis

Fundamental analysis examines economic data, interest rates, and global events. Understanding economic indicators, central bank decisions, and market sentiment can help traders anticipate larger price movements.

Forex Trading Strategies on AvaTrade for Different Trading Styles

Not all traders approach the market the same way. AvaTrade supports multiple strategy types based on time commitment and risk tolerance.

Short-Term Trading Strategies

Short-term traders focus on rapid price movements and quick execution. These strategies require:

High market liquidity

Fast execution speed

Strong volatility awareness

Short-term trading is suitable for traders who can actively monitor the market.

Medium-Term Trading Strategies

Medium-term traders aim to capture trends over several days. This style relies on:

Trend confirmation

Balanced risk exposure

Technical and fundamental alignment

Long-Term Trading Strategies

Long-term strategies focus on broader market trends and macroeconomic factors. Traders using this approach emphasize:

Risk-to-reward ratios

Lower trade frequency

Strong market fundamentals

Understanding CFD Contracts in AvaTrade

Understanding CFD Contracts in AvaTrade is essential for traders looking to diversify beyond traditional forex pairs. CFDs allow traders to speculate on price movements without owning the underlying asset.

How CFDs Work

CFDs track the price difference between entry and exit. Traders can:

Trade rising or falling markets

Use leverage to increase exposure

Access global markets from one account

Key Considerations When Trading CFDs

Margin requirements

Market volatility

Overnight holding costs

Position sizing

Proper planning and risk assessment are critical when trading CFDs.

Risk Management as a Core Trading Principle

Risk management is what separates sustainable traders from unsuccessful ones. AvaTrade provides tools that help traders control losses and protect capital.

Essential Risk Management Practices

Setting stop-loss orders

Using take-profit levels

Limiting leverage

Managing trade size

Professional traders focus on protecting capital first, profits second. This mindset is crucial for long-term success.

AvaTrade Strategies for Beginners

AvaTrade Strategies for Beginners are designed to help new traders enter the market with confidence. Simplicity and education play a major role at this stage.

Beginner-Focused Features

Demo trading environment

Educational materials

Simplified platform layout

Clear trade execution

Recommended Beginner Approach

Focus on major currency pairs

Use conservative leverage

Trade during active market hours

Keep a trading journal

These steps help beginners build consistency while minimizing unnecessary exposure.

Psychology and Discipline in Trading

Trading psychology is often underestimated. Emotional reactions such as fear and greed can negatively affect performance.

How to Maintain Trading Discipline

Follow predefined rules

Avoid overtrading

Accept losses as part of trading

Focus on long-term consistency

A structured mindset supports better execution and more rational decision-making.

Automated Trading with AvaTrade

Automated Trading with AvaTrade has become an essential option for traders who want efficiency and consistency. Automation allows trades to be executed based on predefined rules without emotional interference. This approach is especially useful for traders who cannot monitor the markets continuously.

How Automated Trading Works

Automated systems use algorithms or expert advisors to analyze market conditions and execute trades automatically. These systems are based on:

Predefined trading rules

Technical indicators

Market conditions

Risk parameters

Once configured, the system operates continuously, responding to market changes faster than manual trading.

Advantages of Automated Trading

Eliminates emotional decision-making

Ensures execution consistency

Allows strategy testing using historical data

Supports time-efficient trading

Automation does not guarantee profits, but it helps traders maintain discipline and structure.

Developing a Consistent Trading Plan

A trading plan defines how a trader operates in the market. AvaTrade supports structured planning through customizable tools and flexible platforms.

Core Elements of a Trading Plan

Market selection

Entry and exit rules

Risk per trade

Position size calculation

Successful traders focus on process optimization rather than chasing profits.

Why Consistency Matters

Consistency builds confidence and allows traders to evaluate performance objectively. Without a plan, traders are more likely to overtrade or deviate from proven strategies.

Advanced Strategy Optimization on AvaTrade

As traders gain experience, they begin refining their strategies. AvaTrade allows advanced users to optimize performance through analysis and testing.

Strategy Optimization Techniques

Backtesting strategies on historical data

Adjusting indicators based on market conditions

Refining risk-to-reward ratios

Monitoring drawdowns

Optimization is an ongoing process that evolves with market behavior.

Trading Tools That Enhance Performance

AvaTrade provides tools designed to support informed decision-making and efficient execution.

Key Trading Tools

Advanced chart customization

Multiple time-frame analysis

Price action analysis

Volatility measurement tools

These tools help traders identify opportunities and manage positions more effectively.

Comparing Manual and Automated Trading Approaches

| Feature | Manual Trading | Automated Trading |

|---|---|---|

| Decision Speed | Moderate | High |

| Emotional Impact | High | Low |

| Flexibility | High | Medium |

| Consistency | Variable | High |

Many traders combine both approaches to benefit from human judgment and automated precision.

Common Mistakes Traders Should Avoid

Even with a strong platform, mistakes can limit performance. Awareness helps traders improve faster.

Frequent Trading Errors

Overleveraging positions

Ignoring risk exposure limits

Trading without confirmation

Changing strategies too often

Avoiding these mistakes improves long-term stability.

Real-World Trading Scenario

A trader starts with a demo account to test a medium-term strategy based on trend analysis. After consistent results, the trader transitions to a live account with reduced leverage. By combining technical indicators with strict risk controls, the trader achieves steady performance over several months.

This example highlights the importance of patience, discipline, and structured planning.

AvaTrade Strategies for Beginners: Long-Term Growth

AvaTrade Strategies for Beginners focus not only on market entry but also on sustainable growth. Beginners who prioritize education and gradual improvement often outperform those seeking quick gains.

Growth-Oriented Beginner Tips

Focus on learning before earning

Track trades using performance metrics

Review mistakes regularly

Gradually increase position size

Long-term success comes from skill development rather than shortcuts.

Building Confidence Through Experience

Confidence in trading is built through repetition and analysis. AvaTrade’s environment supports continuous learning and refinement.

How Confidence Develops

Consistent execution

Clear strategy rules

Realistic expectations

Controlled risk exposure

Confidence helps traders remain calm during market volatility.

Frequently Asked Questions (FAQ)

Q1: Is AvaTrade suitable for automated trading systems?

Yes, the platform supports automated systems through advanced trading tools and stable execution environments.

Q2: Can beginners use professional trading strategies?

Yes, beginners can adapt simplified versions of professional strategies while maintaining strict risk control.

Q3: What is the biggest risk in CFD trading?

Leverage increases both potential gains and losses, making capital protection essential.

Q4: How long does it take to become consistent in trading?

Consistency depends on learning speed, discipline, and strategy development. There is no fixed timeline.

Q5: Should traders focus on one strategy or multiple strategies?

Most successful traders master one strategy before expanding to others.

Conclusion and Call to Action

Trading success is not achieved overnight. AvaTrade provides the structure, tools, and flexibility needed to support traders at every stage of their journey. By focusing on planning, discipline, and continuous improvement, traders can build strategies that align with their goals and risk tolerance.

Whether you choose manual execution, automation, or a hybrid approach, the key is commitment to strategic development and long-term consistency.