Upwork Fees Explained: A Guide to How Much You Actually Take Home

Have you ever wondered exactly how much of your hard-earned freelance income you’re actually keeping after Upwork takes its cut? When you log in and accept a job, do you fully understand what portion of the agreed payment lands in your bank account? And more importantly—do you know how to strategically manage those deductions to maximize your take-home pay?

In this guide, we’ll break it all down, and more. From the controversial Upwork 20% fee to sliding scale fees and payment protection, you’ll gain clarity about what happens behind the scenes of your Upwork transactions, This is Upwork fees explained in plain English—with real-world scenarios and actionable advice.

Whether you’re a new freelancer wondering what “service fees” even mean, or an experienced contractor frustrated by rising deductions, this article will give you practical steps to make informed financial decisions. You can boost your income through Mastering Your Upwork Pricing Strategy: How to Set Rates That Attract Clients and Boost Your Income.

Let’s get started by demystifying Upwork’s fee model.

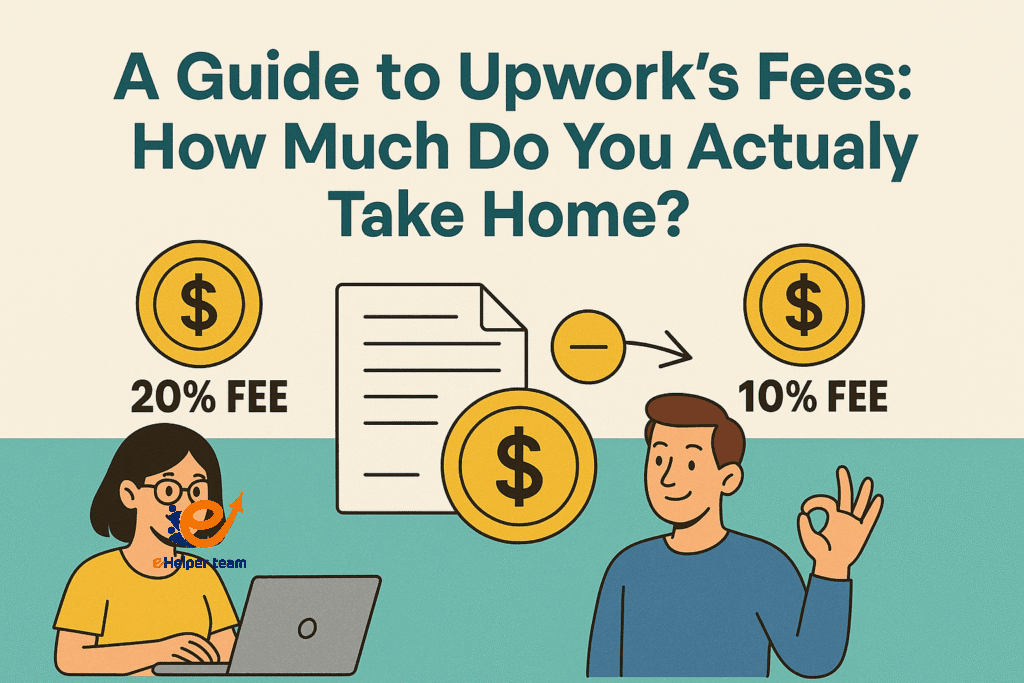

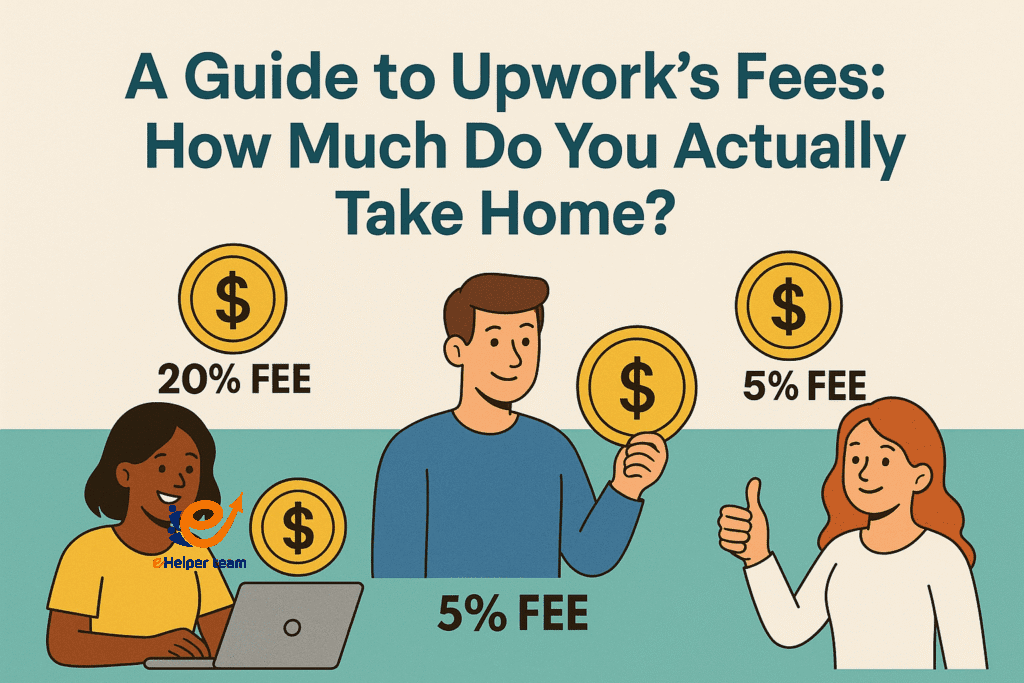

How the Sliding Scale Works

Upwork operates on a tiered service fee structure to encourage long-term collaboration between freelancers and clients:

20% on the first $500 billed to a client

10% from $500.01 to $10,000

5% after surpassing $10,000

This sliding scale fee rewards client retention. But initially, that 20% fee can hit hard for small projects.

The Standard Upwork 20% Fee

For most new freelancers, the first project often incurs Upwork’s 20% fee. So, if you’re paid $100 for a task, you only receive $80.

This might seem steep, but it funds platform features like dispute resolution, payment protection, and fraud prevention.

Understanding Upwork’s Fee Structure

1.Fixed-Price vs Hourly Contracts

Fixed-price projects deduct fees once escrow is released.

Hourly contracts automatically log hours using Upwork’s desktop app and deduct fees weekly.

Each method comes with its own accounting needs and impacts your bottom line differently.

2.Client Marketplace Fees

In addition to what freelancers pay, clients also pay Upwork—usually a flat 5% marketplace fee. These additional charges influence total project costs and client behavior.

How to Calculate Your Net Earnings

Earnings Calculator Walkthrough

To estimate what you’ll actually make, use Upwork’s earnings calculator:

| Gross Pay | Upwork Fee | You Keep |

|---|---|---|

| $100 | $20 (20%) | $80 |

| $600 | $80 (20% of first $500, 10% of next $100) | $520 |

| $12,000 | ~$1,100 | ~$10,900 |

These breakdowns help you understand the real impact of fees.

Common Misconceptions About Take-Home Pay

Many freelancers forget that they’re charged per client, not per project, That means each new client restarts the fee tier.

Real Example: What Freelancers Really Make After Fees

$500 Contract Breakdown

Let’s say you land a $500 one-time gig. After a 20% deduction, your actual income is $400—not including any withdrawal or currency exchange fees.

$10,000 Long-Term Client Example

Long-term relationships yield better returns. For a $10,000 contract:

First $500: 20% fee = $100

Next $9,500: 10% fee = $950

You keep $8,950

Hidden Costs Beyond Upwork’s Fee

Conversion and Withdrawal Fees

Freelancers outside the U.S. may pay $1–$3 per withdrawal plus a currency exchange fee—often between 1.5%–3%.

Currency Exchange Losses

Depending on your bank and country, exchange rate markups can further reduce your net earnings.

Strategies to Reduce Fee Impact

Raise Your Rates Smartly

Set prices with Upwork’s commission in mind. If your goal is to earn $100, quote $125 to account for the fee.

Learn more in this Upwork scam prevention article.

Work with Long-Term Clients

As seen above, Upwork reduces the fee as your earnings per client increase. This benefits both parties over time.

Build a Reputation to Qualify for Lower Fees

Top-rated freelancers often earn more per project due to increased trust and credibility.

Payment Protection: Is It Worth the Fee?

How Upwork’s Payment Protection Works

Hourly contracts come with automatic payment protection if logged properly. For fixed-price projects, funds must be in escrow to be protected.

Comparing with Other Platforms

Upwork’s system is more secure than many freelance platforms. Just see how it compares on Investopedia.

Pros and Cons of Upwork’s Commission Model

| Pros | Cons |

|---|---|

| Structured and predictable fees | High 20% entry-level fee |

| Escrow and dispute protection | Per-client fee tier resets |

| Lower fees with repeat clients | Extra costs like withdrawals |

A graphic designer moved from $10/hour to $30/hour by switching to longer-term contracts and charging in USD only, avoiding repeated high fees.

Resources for Better Freelance Pricing

Explore this step-by-step guide to Upwork pricing:

Mastering Your Upwork Pricing Strategy.

And for complete beginners, here’s your go-to roadmap:

Upwork Beginner Guide 2024.

Comparing Upwork Fees to Other Freelance Platforms

Understanding how Upwork’s fee structure compares to other popular freelance platforms helps freelancers make smarter platform choices. Here’s a breakdown of common platforms:

| Platform | Standard Fees | How Fees Are Applied |

|---|---|---|

| Upwork | 20% → 10% → 5% per client | Based on client lifetime billing |

| Fiverr | 20% flat | Per transaction |

| Freelancer | 10% or $5 (whichever is greater) | Per project or hourly contract |

| Toptal | Custom (premium) | Based on screening and contract type |

Upwork’s sliding scale benefits freelancers who build long-term relationships. Platforms like Fiverr charge a fixed 20% regardless of the job size or repeat clients.

Use a Fee Calculator to Plan Your Pricing

One practical way to plan your take-home pay is to use an Upwork earnings calculator. These tools allow you to enter your target income and automatically compute how much you need to charge to meet your goals after fees and taxes.

Many freelancers build their own Excel spreadsheets, while others use browser-based calculators.

If you want to go a step further, use Google Sheets templates that factor in:

Upwork tiered fees

Withdrawal charges

Tax estimation

Currency conversion margins

Tax Considerations for Freelancers on Upwork

Freelancers in the US and UK must factor Upwork fees into their tax deductions. These service fees are considered business expenses, which means they are deductible on tax returns.

Upwork provides documentation such as:

Transaction History Reports

Annual Summary Reports

Form 1099-K (for U.S. freelancers earning over $20,000 with 200+ transactions)

It’s crucial to download and archive these documents for annual tax filing.

Real-World Scenarios: Understanding Earnings in Context

Let’s consider how fees play out across different freelance situations:

New Freelancer with Short Projects

If you work with 5 different clients on $200 projects, you’ll pay 20% on each—totaling $200 in fees from $1,000 in earnings.

Experienced Freelancer with Long-Term Client

A single client with a $10,000 contract will yield significantly lower fees: you’ll only pay $1,050 (first $500 at 20%, rest at 10%).

International Freelancer with Currency Risk

A freelancer in India working with USD clients may lose 2-3% on exchange rates + local bank fees, reducing net income despite Upwork fee tiers.

Psychological Pricing Strategies to Offset Fees

To keep offers appealing to clients while still covering fees, freelancers often apply psychological pricing. Examples:

Instead of quoting $100, set your rate at $97. After Upwork’s 20% cut, you keep ~$77.60—almost the same but more marketable.

Use “Tiered Service Packages” (Basic, Standard, Premium) to shift attention from raw cost to perceived value.

This pricing approach makes your services more attractive and subtly offsets the platform’s fee impact.

Frequently Asked Questions

Q1: Is Upwork’s 20% fee worth it for beginners?

Yes, it covers platform security and client access, though you should aim for long-term clients to reduce fees.

Q2: Do I get charged the fee on bonuses or tips?

Yes, the same percentage applies unless otherwise specified.

Q3: Can I negotiate Upwork’s fees?

No, they are standardized. However, you can increase your rate to offset them.

Q4: Are there any fees for withdrawing money from Upwork?

Yes, expect a withdrawal fee of $0.99 to $3 depending on method, plus potential currency losses.

Q5: Does Upwork offer any tax documentation?

Yes, Upwork provides tax forms such as 1099-K (US freelancers only).

Conclusion

Navigating Upwork fees explained doesn’t have to be overwhelming. Once you understand how the sliding scale fees operate, and how to plan around the Upwork 20% fee, you can make strategic choices to protect your income and thrive on the platform. From payment protection to building client relationships, knowing the fee structure gives you the upper hand.