QTUM is traveling to the moon, a simplified explanation

Among today’s fastest-rising cryptocurrencies, QTUM is standing out as a “moonshot” project. Within just hours, it surged from $88 to $93 and climbed in global market rank from 15th to 14th place. Such rapid movement captures the essence of the crypto phrase “to the moon”—a term used when a digital asset shows unstoppable growth. But what exactly is QTUM, and why is it suddenly gaining this much traction?

This article offers a clear explanation of QTUM’s technology, its unique hybrid model, and why experts believe it could be among the most impactful blockchain projects of the decade. We’ll also explore risks, growth drivers, and real-world adoption.

What Is QTUM and Why Is It Skyrocketing?

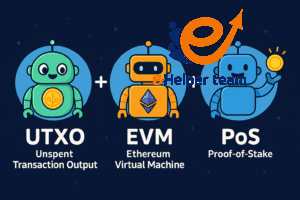

QTUM is a decentralized blockchain platform that blends Bitcoin’s tried-and-tested Unspent Transaction Output (UTXO) system with Ethereum’s flexible smart contract engine. This fusion gives it a unique advantage: the reliability of Bitcoin’s transaction model combined with the programmability of Ethereum.

Its recent price movement—jumping from $88 to $93—signals investor enthusiasm. Even more telling, QTUM improved its global ranking by one spot in just a matter of hours, highlighting growing demand. This trend suggests that investors view it as a high-growth digital asset.

The “moon” narrative for QTUM isn’t just hype. It reflects a convergence of strong market fundamentals, enterprise-level adoption potential, and growing developer interest in decentralized applications (DApps). With global institutions beginning to embrace blockchain technology, QTUM is positioning itself at the intersection of business and community innovation.

How the Hybrid Model Works: UTXO + EVM

What makes this blockchain distinctive is its ability to merge two paradigms into one cohesive system:

UTXO (Unspent Transaction Output) – the foundation of Bitcoin, ensuring high security, traceability, and transparency.

EVM (Ethereum Virtual Machine) – the execution layer for Ethereum smart contracts.

A “smart layer” is introduced to translate UTXO data into a format readable by the EVM. This innovation allows Ethereum-style contracts to operate seamlessly on top of the UTXO framework. Developers familiar with Solidity can migrate existing projects with minimal adjustments.

The result is a network that provides enterprise-grade stability while maintaining programmability, opening opportunities for startups, businesses, and independent developers to create decentralized applications with speed, scalability, and security.

Proof-of-Stake: Energy-Efficient and Rewarding

Unlike energy-intensive Proof-of-Work mechanisms, this network employs Proof-of-Stake (PoS), specifically an Incentivized PoS (IPoS) system.

Here’s how it functions:

Users stake their tokens to participate in transaction validation.

Validators are selected based on the size of their stake rather than computational power.

Rewards are distributed to participants, creating a sustainable incentive model.

This approach ensures energy efficiency, encourages long-term holding, and enhances network security. For participants, staking becomes both a means to secure the chain and a way to earn passive income.

The model promotes decentralization, reduces environmental impact, and aligns incentives among all stakeholders—one reason it’s increasingly seen as a forward-looking blockchain design.

Ethereum Compatibility and Real-World Interoperability

One of its strongest advantages lies in full compatibility with Ethereum smart contracts. Developers can deploy Ethereum-based apps directly without rewriting code, dramatically lowering migration barriers.

This cross-chain interoperability ensures relevance even as ecosystems evolve, giving businesses access to both reliability and flexibility.

Industry experts have praised this bridging capability:

Bo Shen described it as the meeting point between blockchain and business.

Anthony Di Iorio highlighted the strength of its development team in Asia.

Roger Ver called it a project worth constant attention.

Such endorsements emphasize its role as a strategic player rather than just another digital currency.

Why It’s Seen as “Traveling to the Moon”

The phrase “to the moon” is often associated with hype, but here it’s supported by solid fundamentals:

Market Performance: A steady climb from $88 to $93 indicates healthy momentum.

Innovative Hybrid Model: Combining UTXO and EVM gives it unique flexibility.

Sustainable Consensus: IPoS makes it eco-friendly and attractive to investors.

High-Profile Endorsements: Recognition from industry pioneers adds credibility.

Ecosystem Growth: New DApps and real-world integrations are expanding.

For many analysts, this blend of price performance and technical innovation justifies the “moonshot” narrative.

Risks and Challenges Ahead

Despite progress, several obstacles remain:

Market Competition: Platforms such as Solana, Cardano, and Ethereum 2.0 are competing for developer adoption.

Regulatory Pressures: Evolving laws worldwide may affect accessibility and usage.

Technical Risks: Vulnerabilities in smart contracts, staking exploits, or scaling challenges are possible.

Volatility: Like all crypto assets, it remains exposed to sudden market swings.

Balancing these risks with opportunities will be crucial for investors and developers alike. While the technology has the potential to soar, prudent risk management is essential for sustainable growth.

Future Prospects and Real-World Use Cases

Looking forward, QTUM’s roadmap includes scalability upgrades, privacy enhancements, and improved staking mechanisms. Its focus is on bridging enterprise applications with blockchain infrastructure.

Potential use cases include:

Supply Chain: Transparent tracking of goods and services.

Finance: Decentralized lending, trading, and asset tokenization.

IoT Integration: Enabling secure machine-to-machine transactions.

NFTs and DApps: Building creative ecosystems on top of QTUM’s hybrid chain.

These prospects position QTUM as a multi-purpose blockchain capable of long-term sustainability beyond speculative trading.

Risks and Challenges Ahead

Despite its progress, this project still faces obstacles that could affect its trajectory:

Market Competition: Other smart contract platforms such as Solana, Cardano, and Ethereum 2.0 are fighting for the same developer and investor base.

Regulatory Pressures: Global regulation remains uncertain, and new policies could shape or restrict blockchain usage.

Technical Risks: Vulnerabilities in smart contracts, staking exploits, or scalability issues could emerge.

Volatility: Like all digital assets, it is not immune to sudden market corrections.

Investors and developers must carefully weigh these risks against the potential opportunities. While the technology shows promise, smart risk management is essential for long-term growth.

Future Prospects and Real-World Use Cases

Looking ahead, the roadmap includes significant improvements in scalability, privacy, and staking mechanics. The ultimate vision is to build a bridge between enterprise applications and decentralized blockchain infrastructure.

Potential applications include:

Supply Chain Management: Transparent and traceable logistics.

Finance: Decentralized lending, trading, and tokenized assets.

IoT Integration: Enabling secure, automated transactions between devices.

NFTs and Digital Apps: Building creative ecosystems on a flexible blockchain foundation.

These possibilities highlight the versatility of the technology and suggest that it could sustain long-term relevance beyond market speculation.

Global Impact on the Blockchain Community

As adoption spreads worldwide, one of the major challenges has been combining scalability with reliability. This network offers a bridge, creating a platform that resonates with both open-source developers and corporate stakeholders.

It is no longer viewed solely as a token to trade, but as a foundation for financial solutions, logistics systems, and enterprise-grade decentralized applications. Research firms increasingly cite it as a model for long-term blockchain development rather than short-term speculation.

Watch for context: QTUM Explained: Introduction & Basics

Strategic Position in Asia and the Chinese Market

Asia—particularly China—remains at the forefront of blockchain innovation, and this project has roots in that environment. Backed by venture capital firms, angel investors, and notable crypto pioneers, it has developed a reputation as a serious competitor in the smart contract space.

Industry leaders like Anthony Di Iorio and Bo Shen have highlighted the strength of its development team, noting that its foundation in Asia provides a strong advantage in the global race for blockchain dominance. Simultaneously, collaborations are expanding into Europe and North America, giving it a truly global reach.

Reference: QTUM Technology Overview (UTXO + EVM)

Technical Analysis and Market Behavior in 2025

Recent market performance shows more than speculative hype. The jump from $88 to $93 was accompanied by higher trading volumes, suggesting that institutional players and larger investors are getting involved.

From a technical perspective, the price has broken through resistance levels, signaling potential for further upward momentum. At the same time, analysts identify strong support zones, which provide stability even if short-term corrections occur. This pattern indicates that growth is underpinned by genuine demand rather than artificial pumps.

The Importance of Global Partnerships

A key factor shaping the future of this blockchain is its ability to form meaningful alliances. By positioning itself as a solution for both enterprises and communities, it has started forging ties in finance, supply chain, and IoT sectors.

These partnerships do more than provide credibility—they bring real-world use cases that enhance the platform’s utility. For corporations seeking secure, scalable, and interoperable blockchain solutions, this hybrid model presents a promising option.

Frequently Asked Questions (FAQs) about QTUM

1. What is QTUM?

QTUM is a hybrid blockchain that combines Bitcoin’s UTXO model with Ethereum’s smart contract capabilities, enabling secure and programmable transactions.

2. How does QTUM differ from Ethereum?

While Ethereum relies solely on EVM, QTUM merges it with UTXO, offering greater transaction transparency and Bitcoin-level security.

3. Is QTUM energy-efficient?

Yes, QTUM uses Proof-of-Stake (PoS), specifically Incentivized PoS, which is far more energy-efficient than Proof-of-Work systems.

4. Can Ethereum DApps run on QTUM?

Absolutely. QTUM is fully compatible with Ethereum smart contracts, allowing seamless migration of DApps.

5. Is QTUM a good investment in 2025?

While no investment is risk-free, QTUM’s recent performance and adoption suggest strong growth potential. However, risks such as regulation and market volatility must be considered.

6. What are the risks of using QTUM?

Competition, technical vulnerabilities, and regulatory changes remain the main risks facing QTUM’s long-term success.

Conclusion: QTUM’s Moonshot Potential

QTUM has emerged as one of the most exciting cryptocurrencies in 2025. With its hybrid design, Proof-of-Stake system, Ethereum compatibility, and rising market presence, it’s no wonder people say QTUM is “traveling to the moon.”

While risks remain, its unique positioning and growing endorsements suggest that QTUM is more than just hype—it is a project with the potential to shape the next wave of blockchain adoption.