Differences between Payoneer and PayPal ” PayPal vs Payoneer “

In today’s fast-paced digital economy, the debate of PayPal vs Payoneer is more relevant than ever. Both platforms empower freelancers, entrepreneurs, and remote workers to send and receive payments globally — but they do so in distinct ways.

For professionals managing international clients, choosing between these two giants can affect how quickly and affordably you get paid. Whether you’re setting up an online business or freelancing full-time, it’s crucial to understand the differences between Payoneer and PayPal to make an informed decision.

If you’ve ever tried to connect PayPal and Payoneer to streamline your global transactions, you’ve likely noticed that both platforms serve different purposes and have different strengths. In this guide, we’ll explore how they compare in fees, usability, security, and global accessibility — and reveal which one truly fits your 2025 needs.

What Are the Core Differences Between PayPal and Payoneer?

When we talk about PayPal vs Payoneer, the key difference lies in their payment infrastructure. PayPal functions as a global digital wallet, while Payoneer operates as a cross-border payment platform that provides users with local bank accounts in multiple currencies.

| Feature | PayPal | Payoneer |

|---|---|---|

| Business Model | Digital wallet | Cross-border banking |

| Supported Countries | 200+ | 190+ |

| Transfer Type | Within the PayPal ecosystem | To bank accounts directly |

| Currencies | 25+ | 150+ |

| Account Type | Personal and business | Freelancer and business-focused |

PayPal’s ecosystem is ideal for those who want instant payments, online shopping integration, and buyer protection. On the other hand, Payoneer excels in global business payments, offering multi-currency accounts and direct withdrawals to local bank accounts.

Moreover, users who often deal with marketplaces like Amazon or Upwork find Payoneer particularly useful because it integrates seamlessly with these platforms.

If you want to understand how these two systems can be connected for smoother transactions, check out this guide on how to link PayPal to Payoneer.

Transaction Fees: Which Platform Offers Better Value?

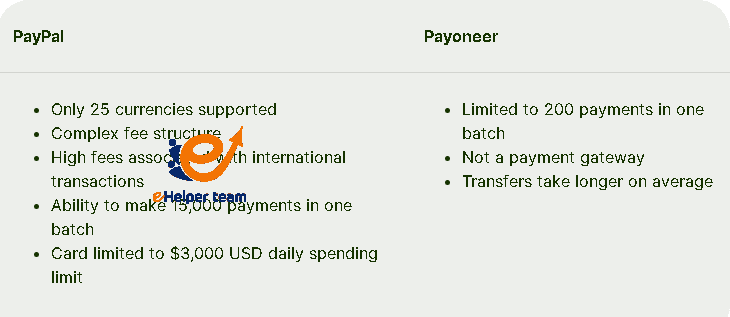

One of the biggest deciding factors between PayPal vs Payoneer is the transaction fee structure.

PayPal Fees:

Receiving money internationally: 4.4% + fixed fee per transaction

Currency conversion: 3–4% markup

Withdrawal to bank: May take 3–5 business days

Payoneer Fees:

Receiving from companies or marketplaces: Free

Receiving from another Payoneer user: Free

Currency conversion: Around 2%

Withdrawal: $1.50 or less, depending on the country

Payoneer’s fees tend to be lower and more transparent, making it a more cost-effective solution for professionals receiving frequent international payments. Meanwhile, PayPal’s brand trust and buyer protection make it more popular among online shoppers and small businesses.

So if you receive payments regularly from global clients or affiliate networks, Payoneer could save you a significant amount each month.

Ease of Use and Account Setup

In terms of setup and user experience, PayPal shines for its simplicity and widespread integration with online stores and websites. Creating a PayPal account takes minutes, and most eCommerce platforms — from Shopify to Etsy — offer native PayPal checkout options.

Payoneer, however, takes a more professional approach. Users must verify identity and sometimes provide tax details before approval. The extra verification step is part of its compliance with international financial regulations.

Still, once you create a Payoneer account, you gain access to a multi-currency account where you can hold USD, EUR, GBP, and other currencies — a huge advantage for global freelancers.

In practice:

PayPal = faster signup, better for small online transactions.

Payoneer is a better long-term tool for professional cross-border work.

Security and Reliability: Which One Protects You Better?

When it comes to global transactions, security isn’t just a feature — it’s a necessity. Both PayPal and Payoneer maintain high standards for protecting user data and funds, yet their approaches differ in scope and focus.

PayPal’s Security Highlights

Uses advanced encryption to secure all transactions.

Offers buyer and seller protection, giving users confidence when purchasing or selling online.

Allows dispute resolution directly through the platform for unauthorized payments or scams.

Payoneer’s Security Framework

Regulated by international financial authorities, including FinCEN (U.S.) and FCA (Europe).

Implements two-step verification and data encryption for all accounts.

Focused on compliance with AML (Anti-Money Laundering) and KYC (Know Your Customer) laws.

Verdict:

PayPal is ideal for e-commerce and online buyers seeking refund protection.

Payoneer is best suited for professionals managing cross-border business payments safely.

If you’re new to Payoneer, check this quick guide on how to create a Payoneer account securely and start receiving international transfers right away.

Global Reach and Supported Countries

When comparing PayPal vs Payoneer, their global presence plays a huge role in determining usability — especially for freelancers and digital nomads.

PayPal’s Global Presence

Available in 200+ countries and territories.

Supports 25+ major currencies.

Offers fast transfers within the PayPal ecosystem.

However, some regions have restrictions — users in certain countries may not be able to receive payments or withdraw to local banks.

Payoneer’s International Coverage

Operates in 190+ countries with multi-currency account options.

Provides local bank account details in USD, EUR, GBP, JPY, CAD, and AUD.

Integrated directly with platforms like Upwork, Fiverr, Airbnb, and Amazon.

Who Wins This Round?

If you serve individual customers, PayPal is more versatile.

If you manage business or marketplace payments, Payoneer offers broader flexibility and lower fees.

To explore more about linking these two services for smoother transactions, you can follow this comprehensive resource on how to connect PayPal and Payoneer effectively.

Which One Is Right for You in 2025?

Deciding between PayPal vs Payoneer depends on what you do and how you receive money. Each platform serves a specific user group:

Choose PayPal if you:

Sell products online (e.g., Shopify, eBay, Etsy).

Need buyer protection and simple transaction tracking.

Frequently handle low-value payments or donations.

Choose Payoneer if you:

Work as a freelancer, consultant, or remote worker.

Require multi-currency accounts for clients across the globe.

Want lower international transfer fees and quick payouts.

Balanced Recommendation

If you’re serious about scaling your business, use both platforms strategically:

PayPal for day-to-day transactions.

Payoneer for large or recurring cross-border transfers.

By integrating both, you’ll maximize financial flexibility while minimizing costs — a key advantage in 2025’s borderless digital economy.

Integration with Freelance Platforms and Marketplaces

While PayPal and Payoneer are both global payment tools, their integration with freelancing platforms varies significantly — and this can determine how easily you get paid.

Payoneer has direct partnerships with platforms like Upwork, Fiverr, PeoplePerHour, Airbnb, Amazon, and Envato. Payments are processed automatically into your Payoneer account, eliminating manual transfers.

PayPal, on the other hand, is often supported on smaller or regional freelancing sites. It works well for individual clients who pay manually via email or invoice, rather than through a third-party platform.

Customer Support and Problem Resolution

Customer support often determines how users perceive a payment platform.

PayPal offers 24/7 customer service, a robust dispute center, and live chat or phone options. However, due to its massive global user base, resolving disputes can sometimes take longer.

Payoneer provides dedicated business support, often faster for verified users or marketplace-linked accounts. Their multilingual support teams are known for handling compliance and account issues efficiently.

Verdict:

PayPal = Better for consumer-related issues and refunds.

Payoneer = Better for business-related disputes and account management.

Mobile App and User Interface Experience

Both PayPal and Payoneer offer mobile apps — but their focus differs.

PayPal App:

Prioritizes simplicity and instant transactions.

Integrates easily with shopping, donation links, and peer-to-peer payments.

Great for users who shop online or transfer small sums regularly.

Payoneer App:

Focuses on professional account management.

Displays currency balances, pending payments, and withdrawal requests clearly.

Offers features like “Request a Payment” or generating payment links for clients.

If you travel often or manage multiple currencies, the Payoneer app provides better control. For daily casual payments, PayPal’s mobile design remains unmatched in speed and ease.

Frequently Asked Questions about PayPal vs Payoneer (2025 Edition)

1. Can I use both PayPal and Payoneer together?

Yes. Many professionals use Payoneer for receiving large payments and PayPal for smaller or retail-related transactions.

2. Can I transfer money directly between them?

Not officially. However, you can link PayPal and Payoneer through your virtual U.S. bank account (if available in your region).

3. Which is safer?

Both are highly secure:

PayPal offers better dispute protection.

Payoneer provides stronger compliance and regulatory oversight.

4. Who has lower fees?

Payoneer is generally cheaper for international transfers. PayPal’s higher fees are offset by convenience and consumer trust.

5. Does Payoneer work everywhere?

Almost — it supports 190+ countries, but availability depends on local banking partnerships and regulations.

6. Can I withdraw money locally from Payoneer?

Yes. Withdraw funds in your local currency directly from your Payoneer balance to your personal or business bank account.

7. Is PayPal verification necessary?

Absolutely. To receive or withdraw money, you must verify your PayPal account with personal details and bank verification.

8. Is Payoneer better for freelancers?

Yes. It was built for freelancers — offering faster international transfers, multi-currency support, and lower fees.

9. Which platform is best for online sellers?

PayPal wins here. It integrates seamlessly with major e-commerce sites and provides trusted buyer protection.

Conclusion

As we step deeper into 2025, the discussion around PayPal vs Payoneer continues to evolve — not because one is necessarily “better” than the other, but because each serves a unique audience in the global payment ecosystem.

PayPal remains the go-to solution for those who value speed, convenience, and trusted buyer protection. It’s ideal for entrepreneurs, small business owners, and anyone involved in e-commerce who needs instant and reliable online transactions.